The future of the automotive industry

The automotive electronics industry has been undergoing a massive transformation for years. Autonomous driving and electrification are driving this revolution. Which is why this industry is showing impressive technologies that answer market needs in term of comfort, safety and power management. Inertial and chemical sensors hubs, as well as imaging and magnetic sensors hubs, are all part of the automotive electronics landscape.

Yole Développement has announced a $11bn market in 2016 with 13.7% CAGR until 2022. At the end of the period, the MEMS and sensors market for automotive applications should reach more than $23bn.

Yole Group of Companies including Yole Développement and System Plus Consulting has been invited to present its vision of the automotive electronics industry, the latest market trends and describe the technology roadmap during the webcast Smart Automotive: Latest Trends in LiDAR and Sensors - a SEMI & Yole Développement Webinar powered by SEMI.

Taking place on 26th October 2017 at 5.00p.m CET, this webcast will detail and analyse the latest information and trends dedicated to innovative sensors as well as in LIDAR for the automotive market segment.

Despite its maturity for some traditional sensors, the MEMS and sensors market for automotive applications is still a very dynamic market segment. While common sensors like pressure or magnetic sensors are still driving the volume within the industry, the momentum coming from imaging and radar sensors will rapidly change the sensing landscape.

While pressure and magnetic sensors used to drive the market, the rise of automated features with ADAS will boost the average cost of sensing systems within a car, thanks to expensive but mandatory components like radars, image sensors and LiDARs.

“Imaging sensors were initially developed for ADAS functionalities in high end vehicles, with deep learning image analysis techniques promoting early adoption,” detailed Guillaume Girardin, Technology and Market Analyst at Yole. “It is now a well-established fact that vision-based AEB is possible and saves lives. Adoption of forward ADAS cameras will therefore accelerate. And these are not the only market drivers...“

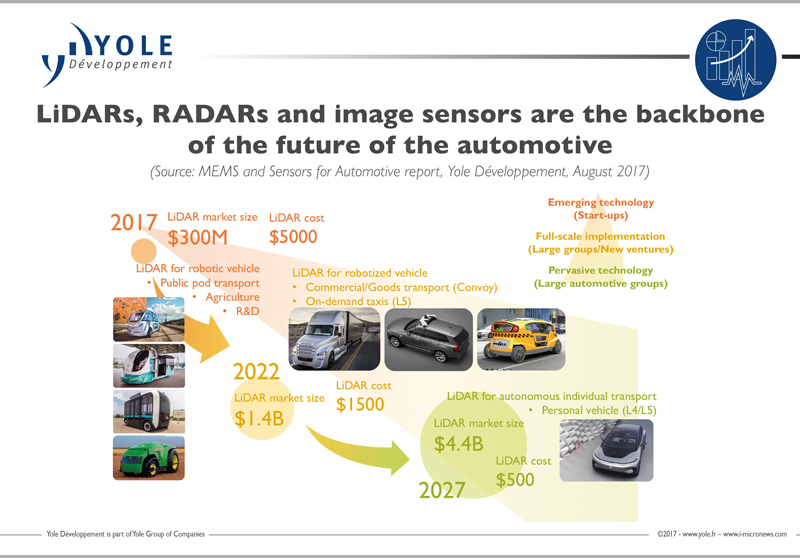

The huge LIDAR market is emerging right now. The market value is expected to grow to $7bn by 2030. Different technologies are competing, but solid-state technology should be the one to remain at the end, announces Yole.

All automotive players are looking for low cost, high performance LIDARs. Some of them are also moving along the supply chain to acquire dedicated know-how. For example, General Motors (GM) announced its acquisition of Strobe this month.

Audi recently announced the production of a fully autonomous vehicle capable of speeds up to 60km/h which includes a LIDAR solution: Audi announced the A8 on 14th July 2017, to be released in September in Europe, and available in the US in 2018. The LIDAR’s cost is estimated to be between $3,000-$4,000.

“The current cost of a LIDAR system for positioning and detection is more than $5,000,” explained Guillaume Girardin from Yole. Due to the high cost of manufacturing, ASP will remain high for some years. As a consequence and because of ROI, only commercial applications and robotic approaches, including taxis, buses and trucks, will have an interest in using such technology.”

This cost should decrease with the arrival of solid-state LIDAR with Velodyne, Quanergy and other players.

During the 'Smart Automotive' webcast powered by SEMI, speakers will provide a deep understanding of automotive sensing challenges. They propose to provide an overview of the automotive sensing industry, including technology trends and market needs, especially regarding autonomous driving. Radar, camera, night vision and LIDAR will be the key words for Yole’s speakers.

In parallel, System Plus Consulting will offer a deep dive into imaging technologies, with the reverse costing of a few existing solutions:

- Front cameras: comparison

- The night vision system from Autoliv & FLIR

- And LIDAR solutions developed by Leddartech and Conti.

“Regarding the radar market, Infineon Technologies can be considered the benchmark and is avidly promoting RADAR as a key technology for the future of automotive,” explained Farid Hamrani, Electronic Systems Cost Analyst at System Plus Consulting.

He further detailed: “Newcomers, especially from the LIDAR industry, may reshuffle the deck in the near future. Companies like Velodyne, Quanergy, SensL and Leddartech are racing against giant automotive suppliers like Continental and Valeo to commercialize reliable and affordable LIDAR solutions that can answer automotive industry requirements.”

Featured speakers of the 'Smart Automotive' webcast include:

• Guillaume Girardin, who works as a Market and Technology Analyst within the MEMS and sensors business unit at Yole Développement.

• Farid Hamrani, who is Electronic Systems Cost Engineer for System Plus Consulting, focused on system reverse costing analysis.

• Bettina Weiss, VP Business Development at SEMI, will moderate this live event.

This live 'Smart Automotive' webcast will be held on 26th October 2017 at 5.00p.m CET.