SiC technology adoption pushed towards the EV/HEV industry

After several years of delays and questioning, SiC (Silicon Carbide) technology confirms its added-value, compared to existing silicon technologies. In its latest report, GaN and SiC Devices for Power Electronics Applications (July 2015 edition), Yole Développement announces the penetration of SiC, from low to high voltage (600 to 3,300V), in the following market segments: PFC, PV, diodes with EV/HEV, wind, UPS and motor drives. Under this new technology and market analysis, Yole’s analysts point out the emergence of SiC dynamic, especially within the EV/HEV market: SiC technology becomes a reality.

The GaN & SiC Devices for Power Electronics Applications report proposes a comprehensive analysis of WBG materials benefits for power electronics applications. Under this report, Yole presents its vision of the SiC technology, its penetration and state of the art at the devices level. Yole’s analysts describe the WBG power device landscape with the related players and their strategy.

In 2014, the SiC chip business was worth more than $133m and, as in previous years, PFC and PV are still the leading applications:

- Today SiC diodes represent more than 80% of the global market. And in 2020, diodes will remain the main contributor across various applications, including EV/HEV, PV, PFC, wind, UPS and motor drives.

- In parallel, Yole’s analysis highlights the SiC transistors growth, driven by PV inverters. Challenges must be overcome prior to the adoption of pure SiC solutions for EV power train inverters, which is nevertheless expected by 2020.

Dr Hong Lin, Technology & Market Analyst, Yole, commented: “Including the growth in both diodes and transistors, at Yole, we expect the total SiC market to more than treble by 2020, reaching $436m."

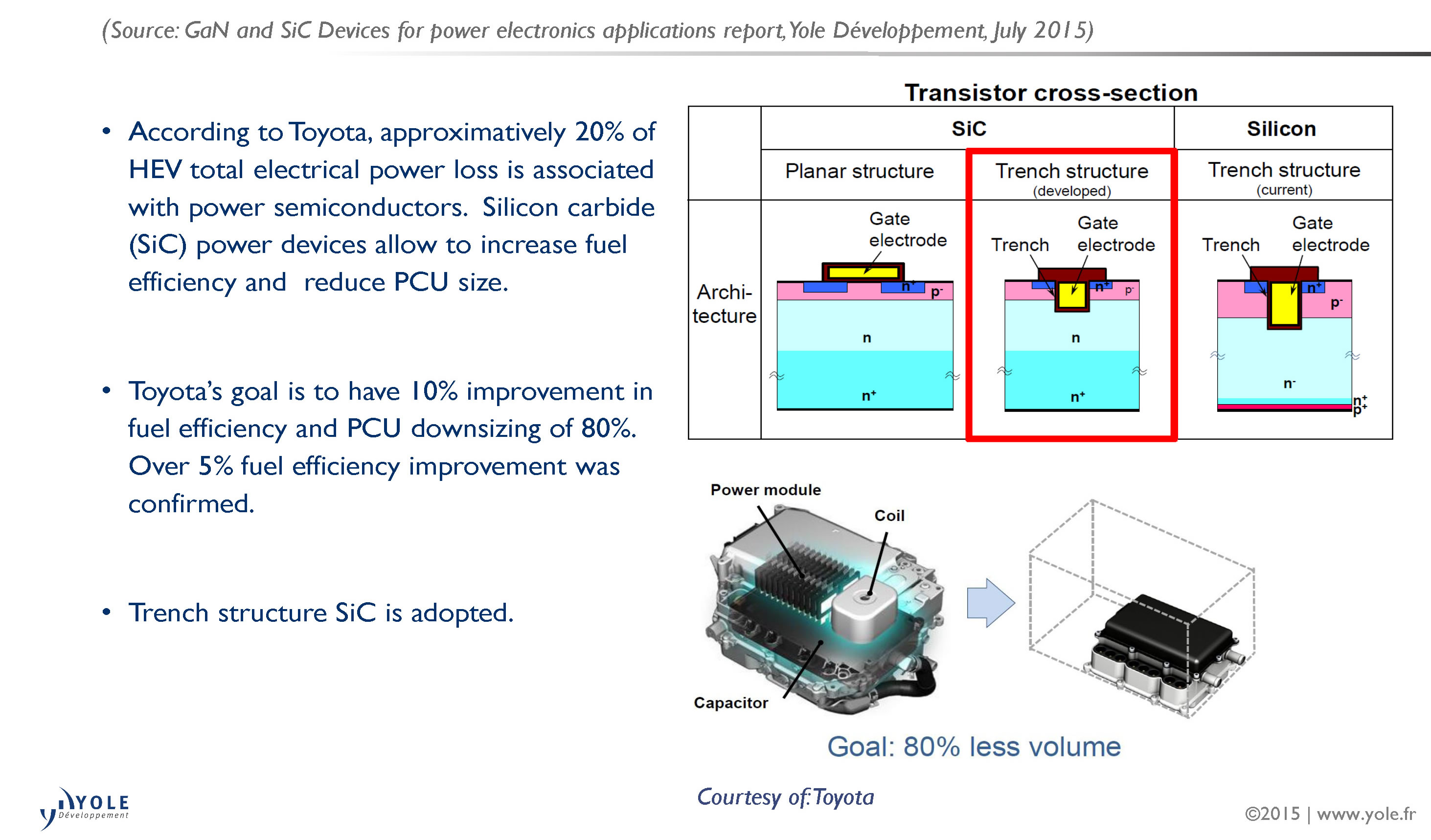

Added value of SiC devices in EV/HEV applications - Toyota's vision

The EV/HEV market is the most promising SiC market segment. Indeed, Yole’s report expects a rapid growth, especially from 2016. Yole’s analysts highlight the huge R&D investments made by the automotive companies within the WBG area.

"Such strategies will clearly make innovations easier and trigger more and more business opportunities,” said Pierric Gueguen, Business Unit Manager, Yole. “In the automotive area, numerous R&D departments are currently working on the development of new solutions. At Yole, we stay convinced that such strategies will allow an important breakthrough in this sector, in a near future.”

In parallel several SiC devices makers are now offering or are going to offer automotive-qualified devices. This step underlines their willingness to enter the automotive industry and answer to the specific needs of automotive players.

In the past, some car makers complained about the lack of large volume SiC devices suppliers: “This situation may also evolve quickly, especially if more and more SiC players achieve their automotive certification,” adds Gueguen. “At Yole, we expect such large volume strategies could lead the SiC technology price erosion.”

At Yole, analysts are daily working with the leaders of the WBG industry to learn more about the latest technical innovations and understand the strategy of each player. Under this new report, the consulting company points out the latest industry news and analyses them. During the first semester of 2015, Yole identified:

- Introduction of a 900V MOSFET platform by Cree, targeting EV/HEV charging systems.

- A road test of SiC in Camry, hybrid prototype and a fuel cell bus, announced by Toyota.

- An automotive-qualified SiC MOSFET released by GE.

- Raytheon, STMicroelectronics, APEI, Rohm... all companies are strongly involved in the SiC technology development and make SiC devices a solid and reliable reality for the integrators.